e-Invoice in UAE: Key Dates and Process

The UAE Ministry of Finance has released Ministerial Decision No. 244 of 2025, which officially sets the roadmap for the Electronic Invoicing (E-Invoice) System in the UAE.

This is a landmark step in the country’s digital tax transformation, ensuring greater compliance, efficiency, and alignment with international best practices. Businesses in the UAE must now prepare for the e-invoicing process and understand the implementation dates, phases, and technologies like Peppol e-invoicing.

If you’re asking “when is e-invoicing coming in UAE?” — here’s everything you need to know.

What is an E-Invoice?

An e-invoice is not just a PDF or scanned invoice. It is a structured digital document issued and exchanged in a standard format (such as XML or UBL) that allows seamless transmission between a supplier’s and buyer’s systems.

In the UAE, the Federal Tax Authority (FTA) will require businesses to issue e-invoices that meet specific technical standards for validation and storage.

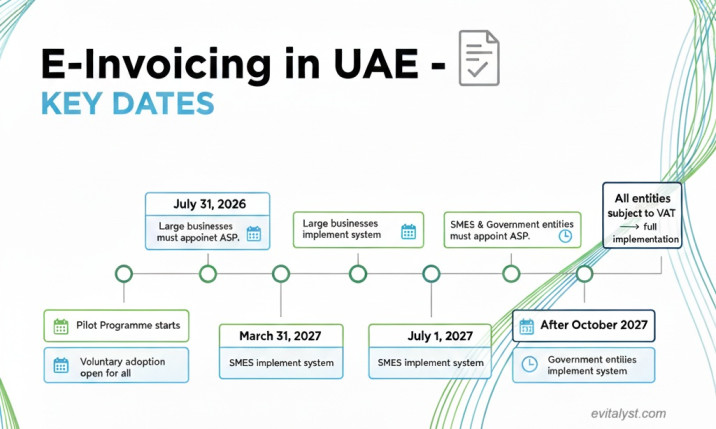

Key E-Invoicing Dates in UAE

The UAE has announced a phased approach:

- Pilot Programme → Starts 1 July 2026 with selected businesses.

- Voluntary Implementation → Available to all businesses from 1 July 2026.

- Mandatory Implementation → Begins in 2027, with deadlines depending on company size:

- Large businesses (Revenue ≥ AED 50M):

- Appoint accredited service provider → 31 July 2026

- Mandatory e-invoicing → 1 January 2027

- Other businesses (Revenue < AED 50M):

- Appoint provider → 31 March 2027

- Mandatory e-invoicing → 1 July 2027

- Government entities:

- Appoint provider → 31 March 2027

- Mandatory e-invoicing → 1 October 2027

- Large businesses (Revenue ≥ AED 50M):

After these dates, all entities subject to VAT must issue e-invoices in UAE.

Source : https://mof.gov.ae/wp-content/uploads/2025/09/Ministerial-Decision-No.-244-of-2025-on-the-Implementation-of-the-Electronic-Invoicing-System.pdf

Who is Exempt from e-Invoicing?

Currently, Business-to-Consumer (B2C) transactions are excluded. Businesses dealing exclusively in B2C will be included later, at a date to be announced by the Minister.

Understanding the E-Invoicing Process

The e-invoicing process typically involves:

- Invoice Creation → Seller generates an invoice in a structured digital format (e.g., XML/UBL).

- Validation → The invoice is validated against technical and legal rules set by the tax authority.

- Transmission → The invoice is securely transmitted through an accredited service provider.

- Acknowledgment → Buyer and FTA receive the validated invoice in real time.

- Archiving → Both parties must securely store the e-invoice for the required retention period.

This process ensures invoices are tamper-proof, standardized, and compliant with VAT regulations.

The Role of Peppol in E-Invoicing

Peppol (Pan-European Public Procurement Online) is a global framework for the exchange of electronic documents such as e-invoices, purchase orders, and shipping notices. Although it started in Europe, Peppol has become an international e-invoicing network used by businesses and governments worldwide.

How Peppol E-Invoicing Works in the UAE Context:

- Standardization → Peppol uses the UBL (Universal Business Language) standard to ensure e-invoices are machine-readable and interoperable across systems.

- Access Points → Businesses connect to the Peppol network via accredited Access Points, which securely send and receive invoices.

- Validation & Compliance → The FTA’s e-invoicing system can integrate with Peppol standards to ensure invoices meet local VAT rules while maintaining international compatibility.

- Cross-Border Advantage → Peppol makes it easier for UAE businesses to trade with international partners who are already using e-invoicing, reducing integration complexity.

In many countries, including Singapore, Australia, and across the EU, Peppol e-invoicing has become the backbone of digital tax compliance — and the UAE is expected to align closely with these global practices.

Why Businesses Should Act Now

Even though mandatory adoption starts in 2027, businesses should begin preparations in 2025–2026 to:

- Upgrade ERP and accounting systems for e-invoice generation.

- Work with accredited service providers familiar with Peppol e-invoicing.

- Test systems during the pilot programme for smoother compliance.

- Avoid last-minute disruptions and penalties.

Final Takeaway

So, when is e-invoicing coming in UAE?

-

- Voluntary e-invoice adoption → 1 July 2026

-

- Mandatory adoption for large businesses → 1 January 2027

-

- Full rollout for all VAT-registered businesses and government entities → By October 2027

The e-invoicing process in the UAE, supported by international frameworks like Peppol, will make financial reporting more efficient, transparent, and globally aligned.

In short: E-invoicing is not just about compliance — it’s about digital transformation. Businesses that prepare early will benefit from automation, accuracy, and smoother cross-border trade.

Contact Information

For additional information concerning this article, please contact: solutions@teksalah.com