UAE e-Invoicing is coming: What ERP-led enterprises need to prepare for now

The UAE is entering a critical phase of tax digitalization. From July 2026, enterprises must exchange eInvoices for B2B and B2G transactions, with the mandate expanding to all taxpayers by 2027. This shift is driven by the adoption of a 5-corner Peppol model, bringing near real-time Federal Tax Authority validations into standard invoicing processes.

Under this framework, invoices must comply with structured XML standards (PINT-AE), mandatory regulatory data validations, and Message-Level Status responses from the FTA within minutes of submission. This marks a fundamental change in how invoices are generated, validated, transmitted, approved, and archived.

For most organizations, this transition extends beyond format changes and regulatory reporting. It directly impacts ERP configurations, order-to-cash and procure-to-pay processes, master data quality, system integrations, exception handling, security controls, and audit readiness.

As enterprises assess readiness, common questions are already emerging:

- Can the ERP generate compliant invoice data and integrate with a Peppol-based e-Invoicing platform without core changes?

- How will mandatory field validations, data inconsistencies, errors, rejections, retries, and MLS timelines be proactively managed?

- What are the implications for data residency, security, long-term archival, and audit readiness?

- Who owns end-to-end accountability across ERP, integration, and compliance layers?

The Role of the System Integrator

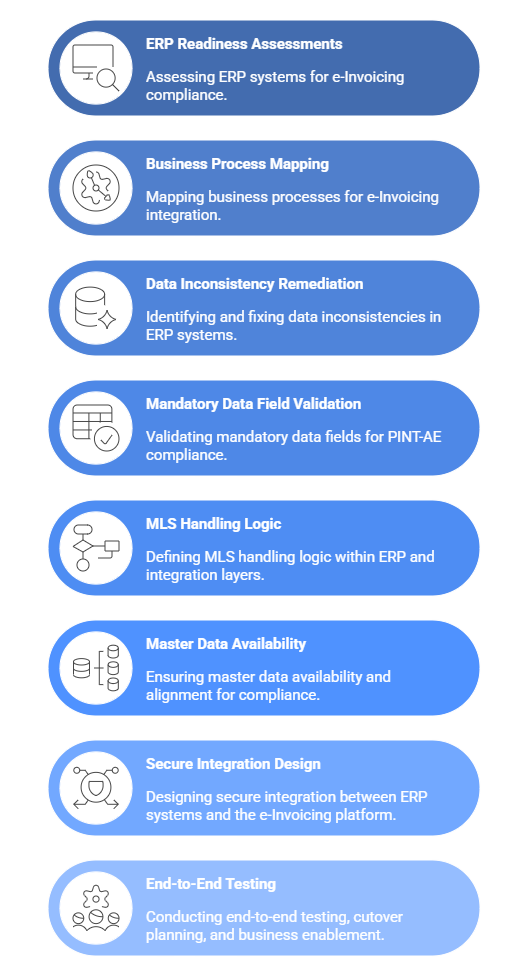

In the UAE e-Invoicing landscape, system integrators play a central role in ensuring successful and sustainable implementation. As your ERP and integration partner, Teksalah continues to own and manage:

- ERP readiness assessments and configuration alignment

- Business process mapping across OTC, P2P, credit notes,

and self-billing where applicable - Identification and remediation of data inconsistencies across ERP master and transactional data

- Validation of mandatory data fields required for PINT-AE compliance before invoice submission

- Definition of MLS handling logic within ERP and integration layers, including error resolution, retries, and business alerts

- Master data availability and alignment

(TRN, VAT categories, document references) - Secure integration design between ERP systems and the e-Invoicing platform

- End-to-end testing, cutover planning, and business enablement

This approach ensures minimal disruption to existing billing, accounts payable, revenue recognition, and reporting processes, while enabling compliance through a dedicated regulatory layer

Working with a Certified e-Invoicing ASP

To address regulatory requirements, Teksalah collaborates with Cygnet.One, a UAE Ministry of Finance pre-approved e-Invoicing solution provider and Peppol-certified Access Point and SMP.

-

- The certified ASP layer is responsible for:

- Regulatory validations and XML transformation aligned to PINT-AE

- Secure invoice exchange over the Peppol network

- Corner 2 and Corner 3 interactions under the 5-corner model

- Message-level status tracking, retries, and audit-ready compliance

- Long-term compliant archival and traceability

- Secure data hosting with enterprise-grade security, access controls, and data residency compliance.

With tight ERP and Cygnet.One integration via secure APIs or SFTP, enterprises avoid managing fragmented systems. Invoice processing, validations, MLS feedback, and compliance tracking operate within a single unified flow, reducing processing time, operational complexity, and reconciliation effort.

Why Early Preparation Matters

Early planning helps enterprises minimize ERP and integration risks, clearly define ownership across ERP, integration, and compliance layers, and ensure audit-ready operations from day one. It also improves invoice acceptance rates, stabilizes payment cycles, and establishes a scalable foundation to adapt to future regulatory changes.

UAE e-Invoicing will enable cleaner, more reliable transactional data, creating opportunities to apply analytics and AI across finance, such as anomaly detection, VAT trend analysis, cash-flow forecasting, and enhanced supply-chain visibility.

To support this transition, we are conducting a readiness discussion to assess the impact on your ERP and business landscape, covering key requirements, architectural considerations, and practical next steps.